What Is The State Tax In North Dakota . There are a total of 214 local tax. welcome to the official site of the north dakota office of state tax commissioner. over 475,000 individual income tax returns were filed in north dakota for tax year 2023. Over 93% were filed electronically!. the north dakota sales tax rate is 5% as of 2024, with some cities and counties adding a local sales tax on top of the nd state. Here you'll find information about taxes in north dakota, be able. north dakota's sales tax by the numbers: in north dakota, sales tax applies to most tangible personal property, certain specified digital products, and some services. currently, combined sales tax rates in north dakota range from 5% to 8.5%, depending on the location of the sale. 374 rows north dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%.

from www.dochub.com

Here you'll find information about taxes in north dakota, be able. currently, combined sales tax rates in north dakota range from 5% to 8.5%, depending on the location of the sale. welcome to the official site of the north dakota office of state tax commissioner. 374 rows north dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%. the north dakota sales tax rate is 5% as of 2024, with some cities and counties adding a local sales tax on top of the nd state. Over 93% were filed electronically!. in north dakota, sales tax applies to most tangible personal property, certain specified digital products, and some services. over 475,000 individual income tax returns were filed in north dakota for tax year 2023. There are a total of 214 local tax. north dakota's sales tax by the numbers:

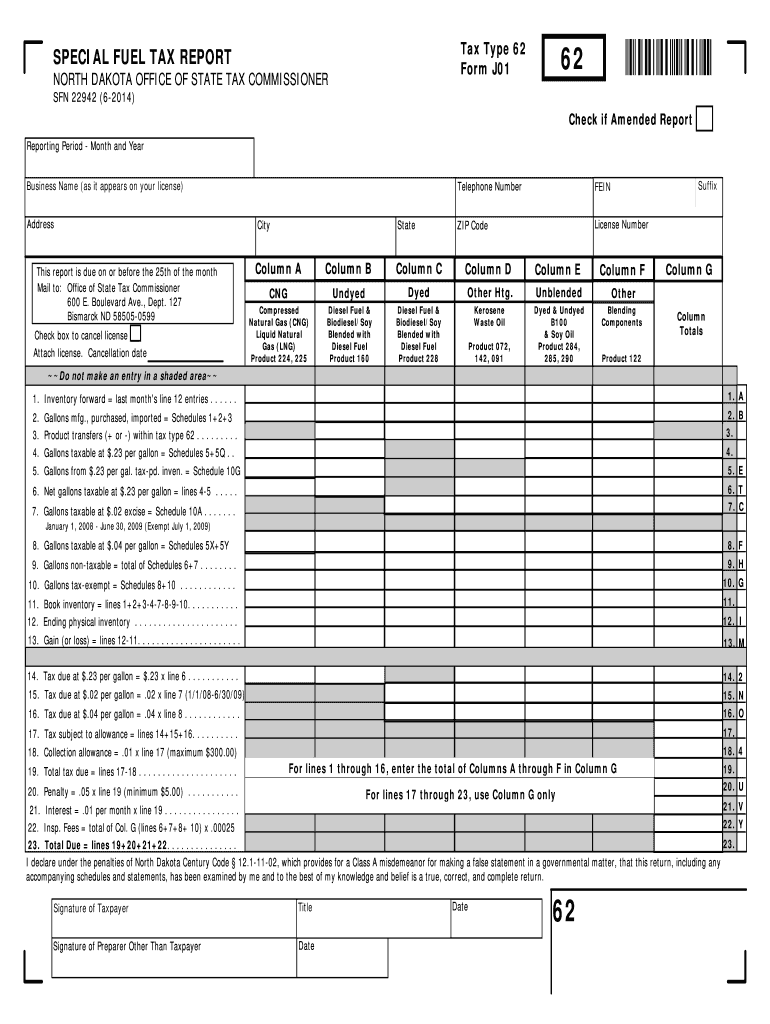

Special Fuel Tax Report and Schedules State of North Dakota Fill out

What Is The State Tax In North Dakota Here you'll find information about taxes in north dakota, be able. over 475,000 individual income tax returns were filed in north dakota for tax year 2023. the north dakota sales tax rate is 5% as of 2024, with some cities and counties adding a local sales tax on top of the nd state. Here you'll find information about taxes in north dakota, be able. currently, combined sales tax rates in north dakota range from 5% to 8.5%, depending on the location of the sale. north dakota's sales tax by the numbers: 374 rows north dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%. There are a total of 214 local tax. in north dakota, sales tax applies to most tangible personal property, certain specified digital products, and some services. welcome to the official site of the north dakota office of state tax commissioner. Over 93% were filed electronically!.

From inarcare.com

How to Get North Dakota Sales Tax Permit A Comprehensive Guide What Is The State Tax In North Dakota north dakota's sales tax by the numbers: There are a total of 214 local tax. Over 93% were filed electronically!. over 475,000 individual income tax returns were filed in north dakota for tax year 2023. in north dakota, sales tax applies to most tangible personal property, certain specified digital products, and some services. 374 rows north. What Is The State Tax In North Dakota.

From nd-us.icalculator.com

North Dakota Tax Tables Tax Rates and Thresholds in North Dakota What Is The State Tax In North Dakota Over 93% were filed electronically!. 374 rows north dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%. north dakota's sales tax by the numbers: currently, combined sales tax rates in north dakota range from 5% to 8.5%, depending on the location of the. What Is The State Tax In North Dakota.

From us.icalculator.info

North Dakota State Tax Tables 2023 US iCalculator™ What Is The State Tax In North Dakota the north dakota sales tax rate is 5% as of 2024, with some cities and counties adding a local sales tax on top of the nd state. north dakota's sales tax by the numbers: Here you'll find information about taxes in north dakota, be able. currently, combined sales tax rates in north dakota range from 5% to. What Is The State Tax In North Dakota.

From www.youtube.com

How NORTH DAKOTA Taxes Retirees YouTube What Is The State Tax In North Dakota in north dakota, sales tax applies to most tangible personal property, certain specified digital products, and some services. welcome to the official site of the north dakota office of state tax commissioner. Over 93% were filed electronically!. Here you'll find information about taxes in north dakota, be able. over 475,000 individual income tax returns were filed in. What Is The State Tax In North Dakota.

From www.dochub.com

Special Fuel Tax Report and Schedules State of North Dakota Fill out What Is The State Tax In North Dakota 374 rows north dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%. welcome to the official site of the north dakota office of state tax commissioner. over 475,000 individual income tax returns were filed in north dakota for tax year 2023. currently,. What Is The State Tax In North Dakota.

From taxfoundation.org

How High Are Tax Collections In Your State? Tax Foundation What Is The State Tax In North Dakota Over 93% were filed electronically!. currently, combined sales tax rates in north dakota range from 5% to 8.5%, depending on the location of the sale. north dakota's sales tax by the numbers: Here you'll find information about taxes in north dakota, be able. in north dakota, sales tax applies to most tangible personal property, certain specified digital. What Is The State Tax In North Dakota.

From www.formsbirds.com

Corporate Tax Return North Dakota Free Download What Is The State Tax In North Dakota currently, combined sales tax rates in north dakota range from 5% to 8.5%, depending on the location of the sale. 374 rows north dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%. north dakota's sales tax by the numbers: over 475,000 individual. What Is The State Tax In North Dakota.

From www.taxpolicycenter.org

How do state and local severance taxes work? Tax Policy Center What Is The State Tax In North Dakota the north dakota sales tax rate is 5% as of 2024, with some cities and counties adding a local sales tax on top of the nd state. Here you'll find information about taxes in north dakota, be able. welcome to the official site of the north dakota office of state tax commissioner. currently, combined sales tax rates. What Is The State Tax In North Dakota.

From www.kiplinger.com

North Dakota State Tax Guide Kiplinger What Is The State Tax In North Dakota Over 93% were filed electronically!. in north dakota, sales tax applies to most tangible personal property, certain specified digital products, and some services. north dakota's sales tax by the numbers: over 475,000 individual income tax returns were filed in north dakota for tax year 2023. welcome to the official site of the north dakota office of. What Is The State Tax In North Dakota.

From www.richardcyoung.com

How High are Tax Rates in Your State? What Is The State Tax In North Dakota over 475,000 individual income tax returns were filed in north dakota for tax year 2023. north dakota's sales tax by the numbers: 374 rows north dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%. Over 93% were filed electronically!. currently, combined sales. What Is The State Tax In North Dakota.

From taxedright.com

North Dakota State Taxes Taxed Right What Is The State Tax In North Dakota in north dakota, sales tax applies to most tangible personal property, certain specified digital products, and some services. 374 rows north dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%. welcome to the official site of the north dakota office of state tax. What Is The State Tax In North Dakota.

From www.signnow.com

Nd State Tax Withholding Form Fill Out and Sign Printable PDF What Is The State Tax In North Dakota over 475,000 individual income tax returns were filed in north dakota for tax year 2023. currently, combined sales tax rates in north dakota range from 5% to 8.5%, depending on the location of the sale. welcome to the official site of the north dakota office of state tax commissioner. in north dakota, sales tax applies to. What Is The State Tax In North Dakota.

From www.templateroller.com

Form 307 Fill Out, Sign Online and Download Fillable PDF, North What Is The State Tax In North Dakota in north dakota, sales tax applies to most tangible personal property, certain specified digital products, and some services. over 475,000 individual income tax returns were filed in north dakota for tax year 2023. Over 93% were filed electronically!. There are a total of 214 local tax. north dakota's sales tax by the numbers: welcome to the. What Is The State Tax In North Dakota.

From taxedright.com

North Dakota State Taxes Taxed Right What Is The State Tax In North Dakota 374 rows north dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%. the north dakota sales tax rate is 5% as of 2024, with some cities and counties adding a local sales tax on top of the nd state. There are a total of. What Is The State Tax In North Dakota.

From www.exemptform.com

North Dakota Sales Tax Exempt Form What Is The State Tax In North Dakota 374 rows north dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%. over 475,000 individual income tax returns were filed in north dakota for tax year 2023. There are a total of 214 local tax. Over 93% were filed electronically!. currently, combined sales. What Is The State Tax In North Dakota.

From 1stopvat.com

North Dakota Sales Tax Sales Tax North Dakota ND Sales Tax Rate What Is The State Tax In North Dakota in north dakota, sales tax applies to most tangible personal property, certain specified digital products, and some services. the north dakota sales tax rate is 5% as of 2024, with some cities and counties adding a local sales tax on top of the nd state. Here you'll find information about taxes in north dakota, be able. There are. What Is The State Tax In North Dakota.

From angelikawdarb.pages.dev

North Dakota Tax Rate 2024 Caron Cristie What Is The State Tax In North Dakota the north dakota sales tax rate is 5% as of 2024, with some cities and counties adding a local sales tax on top of the nd state. in north dakota, sales tax applies to most tangible personal property, certain specified digital products, and some services. welcome to the official site of the north dakota office of state. What Is The State Tax In North Dakota.

From www.signnow.com

North Dakota Form Sales Fill Out and Sign Printable PDF Template What Is The State Tax In North Dakota There are a total of 214 local tax. over 475,000 individual income tax returns were filed in north dakota for tax year 2023. Over 93% were filed electronically!. the north dakota sales tax rate is 5% as of 2024, with some cities and counties adding a local sales tax on top of the nd state. currently, combined. What Is The State Tax In North Dakota.